The global medical devices market has been growing rapidly in recent years, with new technologies and innovations driving growth in key regions worldwide.

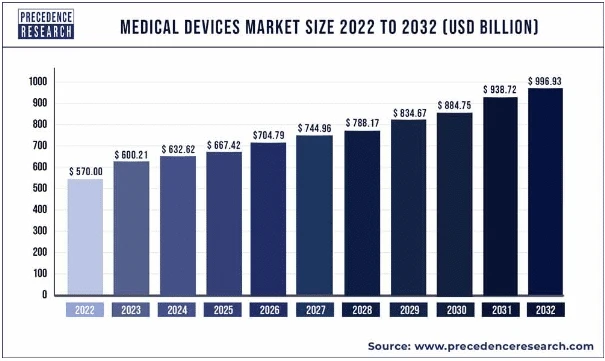

According to reports, the medical device market is expected to make a revenue of $595 billion in 2024, with projections suggesting that it will reach $886.80 billion by 2032.

Several factors contribute to the growth of the medical device market, including the emergence of new innovative technologies, increasing world population, growing public health concerns, improved medical infrastructure, and more.

The market is seeing significant growth in key regions around the world, including Asia Pacific, South America, and Africa, where rising per capita income, an ageing population, and growing public health concerns are driving demand for medical devices.

In this blog, we will explore in detail the fastest-growing medical device markets and the importance of translation for entering new markets and ensuring compliance with regulatory requirements.

The current largest market for medical devices

The current largest markets for medical devices by region are:

1: United States

The U.S. medical device market is valued at approximately $199 billion in 2025 and is projected to reach $315 billion by 2032 It is driven by strong regulatory frameworks, a culture of innovation, and widespread adoption of advanced technologies like wearables and surgical robotics.

2: China

China’s medical device market reached about 1.35 trillion yuan (188.2 billion USD) in 2024, driven by innovation, hospital upgrades, and rising healthcare demand. Major companies earned over 540 billion yuan in revenue, showing rapid growth over nearly a decade.

The market is projected to exceed 200 billion USD in the coming years, making China one of the largest and fastest-growing medical device markets globally.

3: India

India’s medical device market is valued at USD 26.96 billion in 2024 and is projected to reach USD 61.55 billion by 2034, growing at a CAGR of 8.6%.

The market is driven by factors such as rise in chronic conditions like diabetes, increased healthcare spending, and improving infrastructure. By 2034, India is expected to hold 62.3% of the South Asia & Pacific market.

4: Japan

Japan’s medical device market is valued at USD 32.38 billion in 2024 and is projected to reach USD 40.03 billion by 2034, growing at a CAGR of 2.1%.

The Growth is supported by rising demand for advanced medical technologies, an aging population, a growing number of diabetic patients, and increased government investment in healthcare infrastructure. By 2034, Japan is expected to account for 24.1% of the East Asia market.

5: Germany

Germany is Europe’s largest medical device market, supported by a strong healthcare system and widespread use of advanced medical technologies. In 2024, the market was valued at USD 37.7 billion and is expected to grow to USD 41.39 billion by 2032, at a CAGR of 3.47%.

Fastest growing medical device markets

Medical devices are instruments, apparatus, machines, implants, or other similar articles that are intended for use in the diagnosis, treatment, or prevention of diseases or other medical conditions.

The global medical devices market is expanding rapidly, with a projected CAGR of 6.3% from 2024 to 2032. While the market is growing worldwide, some regions are experiencing particularly rapid growth. Here are the top three fastest-growing regions for medical devices:

1. Medical device demand and growth in North America

North America is one of the largest regions in the medical devices market, with a projected CAGR of 5.35% from 2024 to 2029. The region also accounts for 39% of the global medical technology market.

According to research, the projected revenue for the North American medical device market is estimated to reach US$ 199.00 billion in 2024, with the US expected to generate the highest revenue compared to countries globally.

The region has a well-established healthcare system and a high level of healthcare spending, which is driving demand for advanced medical technologies.

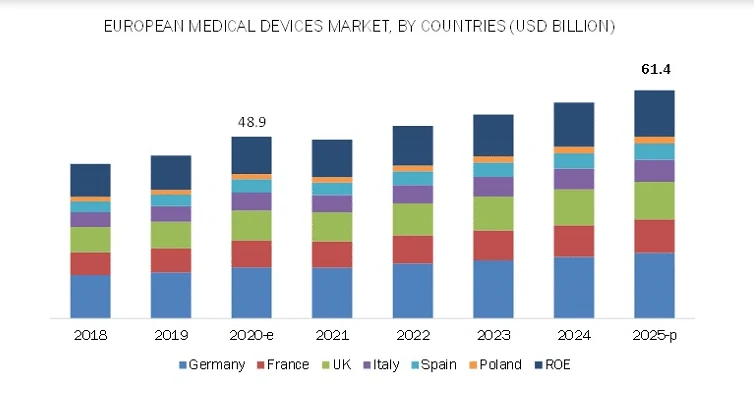

2. Medical device demand and growth in Europe

Europe is also experiencing rapid medical device market growth, with a projected CAGR of 4.9% from 2024 to 2032.

Key Markets Driving Growth in Europe

1: Germany

Germany is Europe’s largest medical device market, supported by a strong healthcare system and widespread use of advanced medical technologies. In 2024, the market was valued at USD 37.7 billion and is expected to grow to USD 41.39 billion by 2032, at a CAGR of 3.47%.

2: United Kingdom

The UK medical device market is expanding steadily, valued at USD 32.28 billion in 2024 and expected to reach USD 62.28 billion by 2035, with a CAGR of 6.18%. The key factors driving the growth are high healthcare investment and digital health integration.

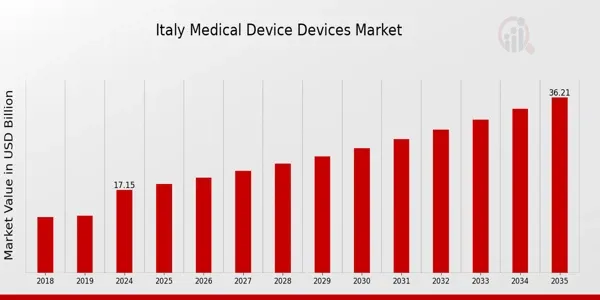

3: Italy

With a market size of USD 17.15 billion in 2024, accounting for 2.5% of regional revenue, Italy is seeing steady growth (CAGR of 7.7%) due to infrastructure upgrades and increased demand for advanced devices.

4: Netherlands

Valued at USD 90.2 million in 2024, the Dutch market is projected to reach USD 159.0 million by 2030, growing at a CAGR of 9.9%, supported by innovation, digital health initiatives, and strong public-private collaboration.

Also read: IFU Translation: Importance, Requirements & Best Practices

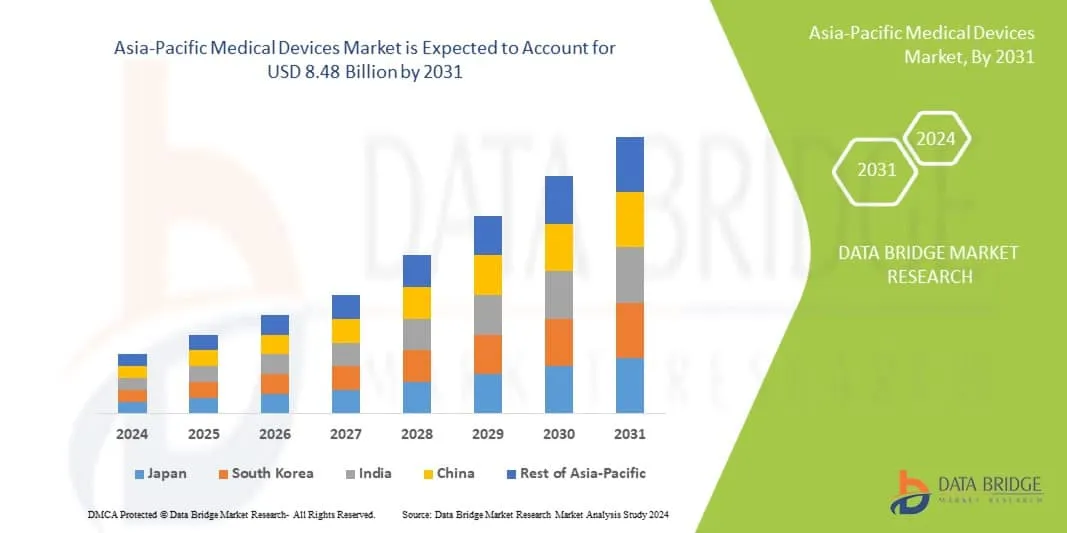

3. Medical device demand and growth in Asia-Pacific

According to research, The medical devices market in the Asia-Pacific region was valued at USD 111.93 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.8%. By 2029, it is forecasted to reach USD 166.1 billion.

Key Markets Driving Growth in the APAC region

1: China

Valued at USD 188.2 billion in 2024, China’s market is expected to exceed USD 200 billion by 2025 with an 8.6% CAGR, the growth is supported by innovation and rising healthcare demand.

2: India

At USD 26.96 billion in 2024, India’s market is projected to reach USD 61.55 billion by 2034 with an 8.6% CAGR, the growth is driven by chronic disease prevalence and healthcare spending.

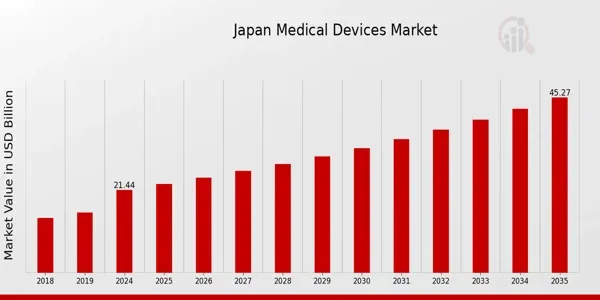

3: Japan

Japan’s market stands at USD 21.44 billion in 2024 and is forecasted to grow to USD 45.27 billion by 2035 at a 7.03% CAGR The market is seeing steady growth due to an aging population and healthcare investments.

4: South Korea

The market reached USD 1.25 billion in 2024 and is expected to grow to USD 2.54 billion by 2030, at a 12.7% CAGR, supported by smart medical device adoption and regulatory support.

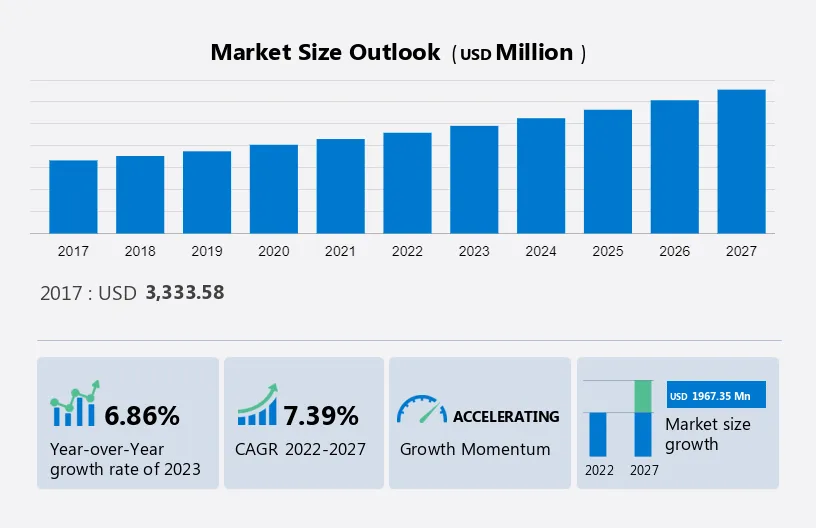

4. Medical device demand and growth in Africa

The medical devices market in Africa is projected to grow significantly, with a CAGR of 7.39% from 2022 to 2027, increasing by a market size of USD 1,967.35 million. By the end of the forecast period, the market size is expected to reach USD 7069.61 million at a CAGR of approximately 6.3%.

Key Markets Driving Growth in the APAC region

1: Egypt

Egypt’s medical device market was valued at USD 4.79 billion in 2024 and is projected to reach USD 6.56 billion by 2034, growing at a CAGR of 3.2%. The Growth is supported by ongoing healthcare reforms, government investment, and rising demand for diagnostic and therapeutic devices

2: South Africa

South Africa’s medical devices market is projected to reach USD 2.88B in 2025 and USD 3.69B by 2030 (CAGR 5.07%).

The key factors driving the growth are rise in healthcare demand, chronic diseases, an aging population, medical tourism, and strong infrastructure, with local manufacturing gradually expanding despite heavy import reliance.

Also read: ICF Translation: Importance, Requirements & Best Practices

Looking for Medical device translation services?

How Can Medical Device Companies Benefit from Translation Services?

Medical device companies can benefit greatly from translation services in several ways:

1. Regulatory compliance

One of the most important benefits is compliance with regulations set forth by regulatory authorities such as FDA in the US, EU MDR, PMDA in Japan, CDSCO in India, NMPA in China, and others.

These regulations require medical device companies to provide accurate and complete documentation in the language of the target market. Failure to comply with these regulations can result in costly fines and delays in product approval.

Translation services play a vital role in preparing regulatory submissions for approval in foreign markets. Translated documents, such as technical files, risk assessments, and regulatory summaries, might be required for the approval processes.

Download our free guide: Medical Device Translation Requirements As Per EU MDR

2. Securing International Patents

Translation services help in fulfilling the language requirement of international patent laws and securing international patents for your medical devices and innovations.

This ensures that the company’s intellectual property is protected in various jurisdictions.

Download our free guide: Navigating Patent Translation A Comprehensive Guide For Global Innovators

3. Market expansion

Medical device companies can expand their customer base by translating their product documentation, marketing materials, IFUs, packaging, and user manuals into the local language of the target market.

Their expertise ensures that branding and messaging resonate effectively with diverse audiences, amplifying market penetration and visibility. Partnering with premium digital marketing agencies can further enhance these efforts by developing region-specific campaigns that strengthen brand presence and drive engagement in new markets.

4. Mitigate risks

Translation services can also help medical device companies to improve the quality of their products. By ensuring that all documentation is accurately translated, companies can reduce the risk of errors, misunderstandings, and misinterpretations.

This can help to improve patient safety and satisfaction and reduce the risk of product liability claims.

Additionally, accurate translation of risk management documents, such as risk assessments, incident reports, and warnings, helps mitigate potential risks associated with medical device use.

In the event of litigation, well-translated documentation can support legal defense strategies and protect the company’s reputation.

5. Gain competitive advantage

By complying with regulations, entering into new markets, improving product quality, and saving time and money, companies can gain a competitive advantage and establish themselves as leaders in the industry.

Medical Device Translation Services: How Should Companies Choose The Right Translation Partner?

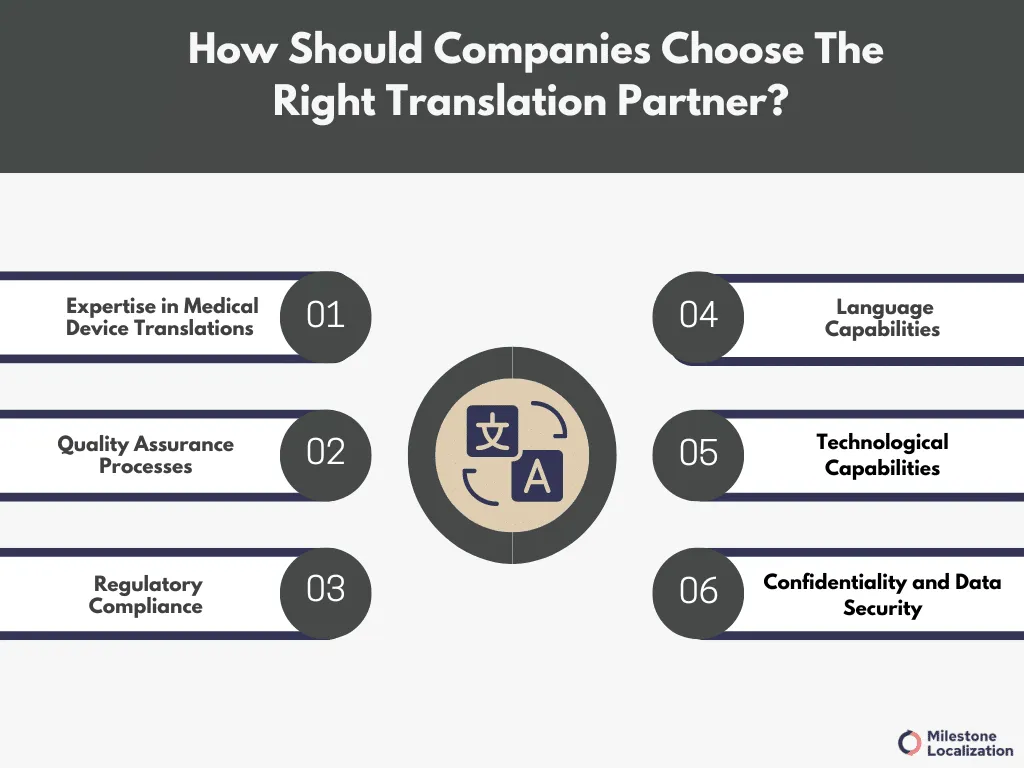

Before selecting a translation partner, medical device companies should carefully consider several factors to ensure a successful partnership:

1. Expertise in Medical Devices

Look for a translation partner with specific experience and expertise in the medical device industry. They should understand regulatory requirements, technical terminology, and industry standards.

2. Quality Assurance Processes

Ensure the translation partner has robust quality assurance processes in place to guarantee accurate and precise translations. This includes translation. Proofreading, quality analysis, adherence to industry standards (ISO 9001, ISO 17100), and use of certified translators.

3. Regulatory Compliance

Verify that the translation partner has experience in regulatory compliance for medical devices, including knowledge of FDA, EU MDR, and other regulatory requirements. They should be able to provide compliant translations for documentation such as IFUs, labeling, and regulatory submissions.

4. Language Capabilities

Assess the translation partner’s language capabilities to ensure they can support the languages required for your target markets. They should have a network of qualified translators proficient in the languages needed for your product localization.

5. Technological Capabilities

Consider the translation partner’s technological capabilities, including compatibility with your systems and software. Look for partners who utilize translation management tools, CAT (Computer-Assisted Translation) tools, and other technologies to streamline the translation process and maintain consistency.

6. Confidentiality and Data Security

Verify that the translation partner has strict confidentiality and data security protocols in place to protect sensitive information. This is crucial, especially when dealing with proprietary or confidential data related to medical devices.

Also read: Medical Translation Agency: How To Choose The Right One?

Why Choose Milestone Localization for Your Medical Device Translation

At Milestone Localization, we combine our industry expertise with strict quality standards to ensure your medical device translations are accurate, compliant, and market-ready.

We are proud to be certified in:

- ISO 13485:2016: quality management systems for medical device documentation translations

- ISO 17100:2015: high-quality translation services with qualified linguists, traceable workflows, and documented quality control

- ISO 9001:2015: general quality management systems

These certifications reflect our commitment to helping medical device manufacturers meet both regulatory requirements and real-world user needs. With a team of native-speaking medical translators and robust translation memory systems.

We help medical device manufacturers with

- EU MDR and IVDR compliance

- Global market entry with multilingual labeling and IFUs

- Accurate and compliant medical device documentation translations

Conclusion

In conclusion, the global medical devices market is rapidly expanding, with projections indicating significant revenue growth. Regions like Asia-Pacific, North America, and Europe are driving this expansion, fueled by factors such as advanced healthcare infrastructure and rising chronic disease rates.

Translation services play a crucial role in enabling medical device companies to navigate these diverse markets by ensuring regulatory compliance, securing international patents, and facilitating market expansion. By leveraging translation services effectively, companies can enhance their competitiveness, drive innovation, and contribute to improved healthcare outcomes globally.

Get in touch with our team to know if we are the right fit for your medical device translation.

Looking for Medical device translation services?

FAQS

What are the fastest growing medical device markets in 2025?

Fastest growing markets include the United States, Asia-Pacific (notably China, Japan, South Korea, and India), Europe (Germany, France, UK), Latin America, and the Middle East & Africa. These regions experience rapid growth due to aging populations, rising chronic disease prevalence, and healthcare infrastructure investments.

What factors are driving growth in the medical device industry?

Growth is fueled by aging global populations, increasing chronic diseases like diabetes and cardiovascular conditions, technological innovations such as AI and robotics, 3D printing for personalized medicine, and demand for smart wearable and connected medical devices.

Why is translation important for medical device companies entering international markets?

Translation ensures that medical device instructions, labeling, regulatory documents, and marketing materials comply with local language requirements and regulatory standards, reducing risks and improving user safety and market acceptance.

What types of medical device content typically require translation?

User manuals, patient information leaflets, packaging, regulatory submissions, marketing collateral, software interfaces, and training materials need accurate translation tailored to the target market’s language and regulatory norms.

Which regions present the biggest opportunities and challenges for medical device translation?

Asia-Pacific offers vast growth opportunities but poses challenges due to diverse languages and regulatory complexity. Europe and North America have stringent regulatory requirements demanding precise translations. Latin America and the Middle East present emerging markets requiring localized content adaptation.

What challenges do medical device companies face when translating for new markets?

Major challenges include specialized medical terminology, differing regulatory requirements in each country, cultural nuances, maintaining technical accuracy, and ensuring timely updates for rapidly evolving devices and documentation.